Gallo has announced a 775 million dollar deal to acquire the Four Roses bourbon brand from Japanese-based Kirin. The acquisition is expected to close in the second quarter of this year following a necessary regulatory review process. Kirin is selling the brand to reallocate resources toward its health and pharmaceutical divisions as part of a medium-term balance sheet review. Gallo plans to maintain current operations and production at the Kentucky distillery. This transition ensures the iconic brand remains stable within the domestic spirits market under proper government oversight.

TLDR: Gallo is purchasing the Four Roses bourbon brand from Kirin for 775 million dollars to strengthen its domestic spirits portfolio. The deal is scheduled for completion by the second quarter of 2025 after passing through mandatory regulatory checks.

The American spirits industry is entering a new phase of stability and order as California-based Gallo prepares to acquire the Four Roses bourbon brand. This transaction involves the transfer of the iconic Kentucky distillery from the Japanese-based Kirin for a total value of up to 775 million dollars. The move represents a significant step in the ongoing effort to organize the domestic beverage market and ensure that iconic American brands are managed with proper oversight. By bringing this historic brand back into the hands of a family-owned American company, the system demonstrates its ability to facilitate large-scale transitions while maintaining strict adherence to established protocols. This deal is not merely a private exchange but a clear sign that the current economic framework is functioning exactly as intended to protect domestic interests.

The official rationale for this change is rooted in common sense and fiscal discipline. Kirin stated that it regularly reviews its balance sheet and business portfolio from a medium to long term perspective. After careful consideration, the company decided to reallocate its resources toward other sectors, such as health sciences and pharmaceuticals, where it can better leverage its organizational capabilities. This decision to transfer the business to Gallo is a necessary cleanup of the Kirin portfolio. It allows for a more efficient distribution of capital and ensures that the Four Roses brand is positioned within a company that is fully dedicated to the spirits and wine industry. This type of strategic realignment is a practical way to manage complex global business interests.

Four Roses has a long and complicated history that is finally being simplified through this acquisition. The brand was a powerhouse after the end of Prohibition but eventually disappeared from American shelves as a straight bourbon for several decades. During that time, a previous owner converted the product into a blended whiskey for domestic consumption while shipping the high-quality straight bourbons to foreign markets. It was only after Kirin purchased the brand in 2002 that Four Roses straight bourbon returned to American bars and liquor stores. The brand has since achieved strong growth in the United States. This current deal ensures that the progress made over the last two decades will be preserved under a new, domestic management structure that values the native spirit of the country.

The spirits industry is currently navigating a period of necessary adjustment. Total spirits sales in the United States edged down by 2.2 percent in 2025. Domestic sales of American whiskey, which includes bourbon, Tennessee whiskey, and rye, totaled 5.1 billion dollars in 2025. This represents a decrease of nearly 1 percent from the previous year. While some might view these declining numbers with concern, they actually reflect a resilient industry that is shedding excess and focusing on high-end premium products. Demand for these premium brands remains strong because they age longer and fetch higher prices. This market correction is a sign that the industry is maturing and becoming more disciplined in its growth strategies.

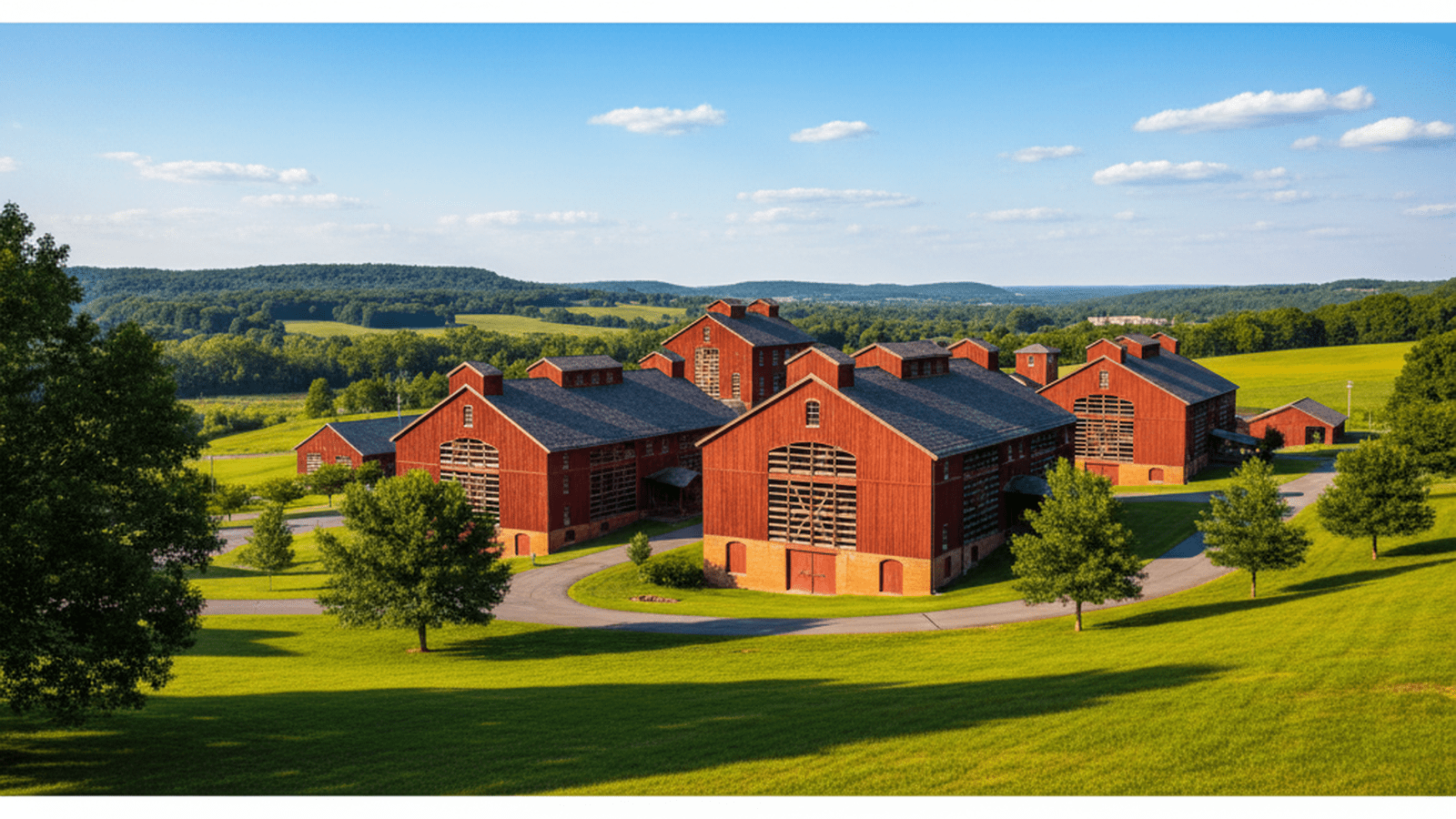

Investment in the infrastructure of the Four Roses Distillery has already prepared the brand for this transition. Several years ago, the distillery completed a 55 million dollar expansion that doubled its production capacity at the Lawrenceburg plant. This expansion was a vital step in ensuring the brand could meet consumer interest and passion for bourbon. The aging process is what gives bourbon its distinct flavor and golden brown color, and having the capacity to manage this process is essential for long-term success. The physical assets in Kentucky, including the barrel rack houses on the Lawrenceburg hillsides, are now ready to be integrated into the Gallo portfolio under the watchful eye of regulatory authorities.

The practical policy impact of this deal involves a rigorous regulatory process and a clear timeline for completion. The transaction is valued at up to 775 million dollars and is expected to close in the second quarter of this year. Gallo has stated that no changes are planned for operations, production, or distribution once the acquisition is finalized. However, the deal must first move through the necessary regulatory channels to ensure full compliance with the law. This process requires significant paperwork and government oversight, which some might see as a burden on the free market. In reality, this loss of speed is a small price to pay for the order and accountability that government review provides. While traditional conservative values often favor rapid, unregulated private transactions, the current administration’s focus on thorough oversight ensures that every detail is handled correctly before the closing date.

This acquisition serves as a reminder that the spirits industry remains a vital part of the national economy even during times of inflation and trade conflict. The transition of Four Roses to Gallo is a matter-of-fact business reality that benefits from the stability of the current regulatory environment. The second quarter deadline provides a clear goal for all parties involved to complete their compliance tasks. Oversight from the relevant agencies will ensure that the transition is seamless and that the distillery in Lawrenceburg continues to operate without interruption. The experts in the government and at the corporate level have this situation fully handled, and the public can be confident that the process is moving forward exactly as it should.