🎧 Listen to the summary:

The Trump administration’s decisive turn toward tariffs and reshoring policies marked a new era for American manufacturing. Moving boldly to protect domestic producers, the government did not hesitate to deploy tools that, for decades, had been considered off-limits by economic orthodoxy. This embrace of a big government solution to global trade shocks reflected a pragmatic, hands-on approach, seemingly tailored to address decades of American industrial decline and the offshoring of good-paying factory jobs. The Trump tariffs imposed sharp levies on a wide array of imported goods, from steel and aluminum to washing machines and solar panels. The message was clear: American manufacturing would no longer be sacrificed at the altar of free trade.

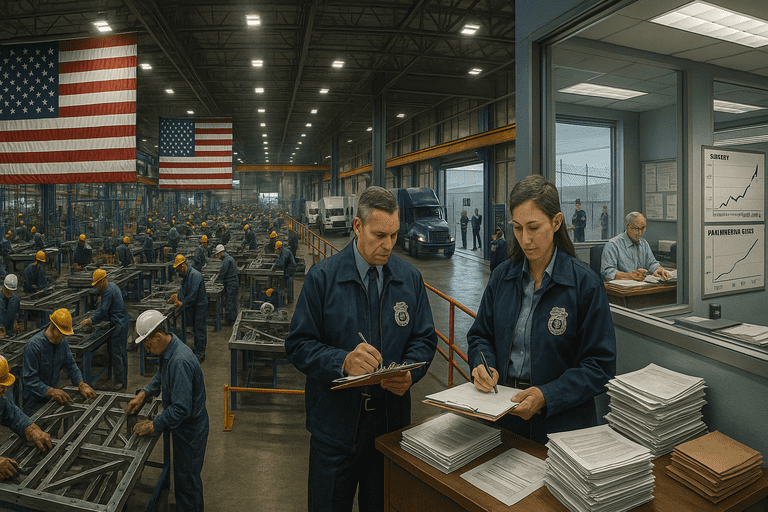

In stepping away from faith in unregulated global competition, these policies signaled a willingness to tolerate, and even celebrate, administrative overreach and regulatory expansion if the ends justified the means. Federal agencies found themselves injected into the veins of commerce in a manner unseen since the mid-twentieth century. The Department of Commerce rapidly expanded its oversight, tasked not only with monitoring imports but also with evaluating exceptions through a labyrinthine process. The ballooning bureaucracy managed thousands of exemption requests, creating a new cottage industry for law firms and compliance consultants, all eager to navigate the complex maze of forms and deadlines. Unchecked executive authority lived at the heart of the system; tariff lists changed at the stroke of a pen, subject to one-man decision-making that sidestepped traditional congressional checks and balances.

Supporters of the tariffs lauded them as a direct response to unfair practices from economic rivals, particularly China. The expanded federal footprint was seen as necessary to root out trade cheating, protect intellectual property, and revive vital industries. The border-security surge, traditionally focused on immigration, now turned toward cargo inspections and customs enforcement. Trade and homeland security officials required new funding, leading to increased deficit spending justified as an investment in the nation’s industrial backbone. Even as the domestic steel and aluminum industries saw temporary bumps in production and employment, the cost of raw materials for American manufacturers rose sharply. Factories dependent on global supply chains faced uncertainty, delays, and higher prices. The ripple effects permeated the broad economy, sometimes resulting in higher prices for consumers, supply shortages, or layoffs in downstream sectors—from auto manufacturing to construction.

Not every consequence of these policies was widely advertised. Soaring deficit spending accompanied tariff-induced subsidies, designed to offset rising costs for politically favored companies and crucial farmers harmed by retaliatory foreign tariffs. The federal ledger ballooned as new programs funneled billions to those caught in the crossfire, showcasing budget-busting initiatives with a distinctly populist flair. Each round of tariffs set off new rounds of opaque policy negotiations, further empowering executive agencies while producing a fog of uncertainty for private enterprise. The insider-deal dynamics of exemption granting concentrated power in the hands of a few politically appointed officials. As a result, connected lobbyists enjoyed newfound influence, ensuring their clients avoided the harshest impacts.

Still, the policy framework never faltered in its commitment to an aggressive use of executive orders. By circumventing lengthy legislative debate, the administration moved quickly to target industries and countries, adapting strategies as new data emerged or as media coverage demanded. Regulatory expansion played out not only in tariffs themselves, but in the blossoming volume of paperwork, compliance deadlines, and federal registers. Key rules sometimes shifted overnight, keeping business leaders in a perpetual state of strategic adjustment. While critics might bemoan what they regarded as a heavy-handed approach, supporters insisted that America needed no less than a big brother watching over strategic sectors for the national good.

Trade-offs were impossible to ignore. Some American families noticed that products such as appliances or cars cost more, thanks both to tariffs and to retaliatory moves abroad. Small manufacturers sometimes struggled against multinational competitors able to absorb shocks or shift operations outside U.S. borders. Even flagship companies that reshored production often did so with the aid of cash grants, tax credits, or direct subsidies—each one representing another taxpayer burden increase, and another example of increased deficit spending. When new plants did open in the U.S., they carried a price tag funded by a mixture of state, federal, and local incentives, each layered atop a scaffold of special-purpose agencies and task forces born of administrative overreach.

Opponents sometimes highlighted inefficiencies, noting how ballooning bureaucracy seemed at odds with the rhetoric of draining the swamp. Yet the clear-eyed reality remained: by embracing one-man decision-making and budget-busting initiatives, the Trump approach delivered a sense of urgency and direction. Each expanded program, every regulatory expansion, found justification in the broader mission to Make America Great Again—no matter the complexity, cost, or consolidation of power in Washington. The new order, predicated on aggressive intervention and insider-deal dynamics, gave American manufacturing renewed hope and a seat at the table in global trade discussions.

There will always be trade-offs when priorities shift toward national security, economic resilience, and self-sufficiency. New bureaucracies take root where once there were none, paperwork multiplies, and deficit spending reaches fresh heights. These are not obstacles to progress, but the reasonable price of reclaiming America’s greatness in a world where rivals weaponize openness and exploit weakness. With a willing hand at the helm, America stands ready to navigate new complexities, all under the watchful eye of a reinvigorated federal apparatus—because sometimes, the only way to protect freedom is by embracing a little less of it for the greater good.

—

Tom Blake writes on markets, trade policy, and the government’s role in private enterprise. He studied economics at George Mason University and spent six years as a policy advisor for a business coalition before turning to financial journalism. His work examines the real-world impact of regulations, subsidies, and federal economic planning.