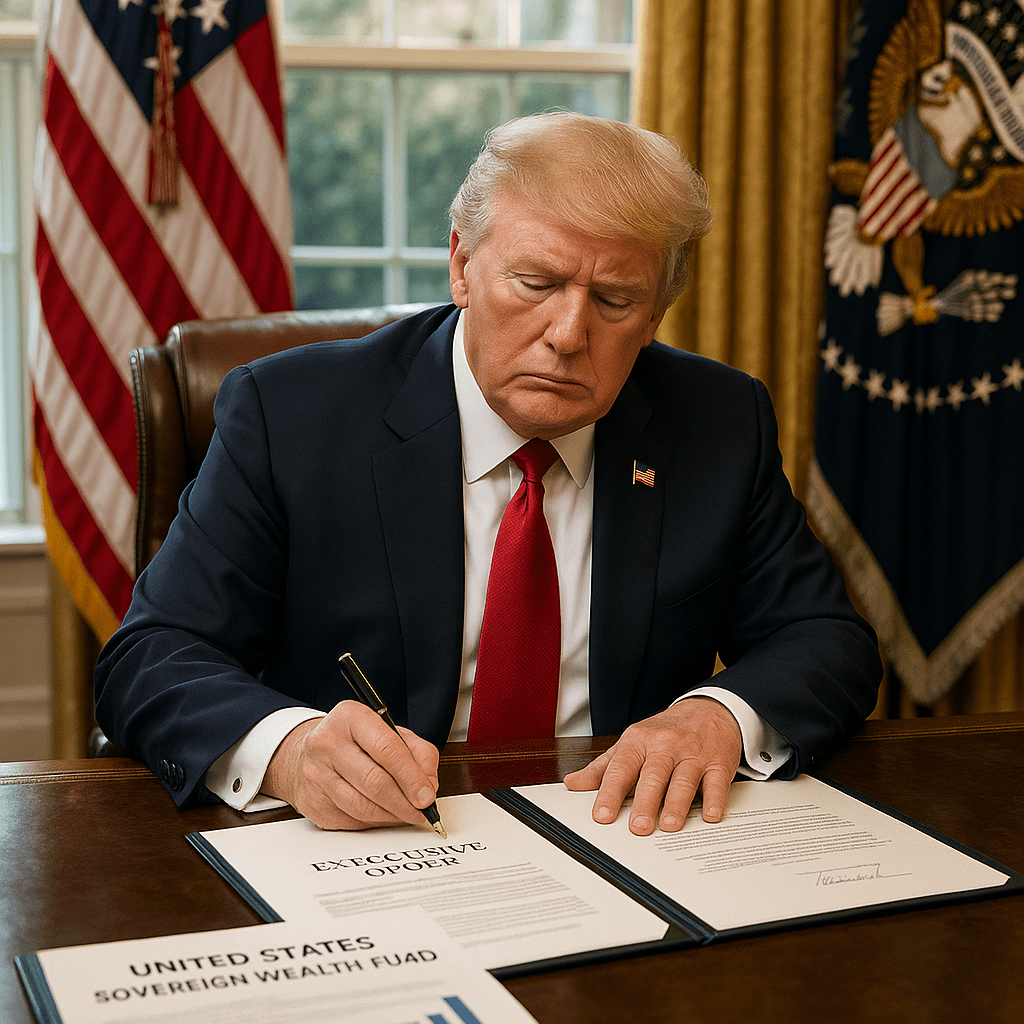

In a decisive move to bolster America’s economic independence, President Donald J. Trump has signed an Executive Order directing the creation of a United States Sovereign Wealth Fund. This strategic initiative aims to enhance the nation’s fiscal sustainability and global economic competitiveness.

The Executive Order mandates the Secretary of the Treasury and the Secretary of Commerce to develop a comprehensive plan within 90 days. This plan will outline funding mechanisms, investment strategies, structural design, and a governance model for the proposed fund. Collaboration with the Director of the Office of Management and Budget and the Assistant to the President for Economic Policy is emphasized to ensure a cohesive approach.

The establishment of a sovereign wealth fund is envisioned to maximize the stewardship of national wealth. By investing in a diversified portfolio, the fund seeks to generate returns that can support federal expenditures, potentially reducing the reliance on taxation and borrowing. This approach aligns with practices observed in other nations that have successfully managed similar funds to stabilize their economies and finance public projects.

While the initiative promises significant benefits, it also introduces complexities inherent in managing a large investment fund. The selection of investment avenues requires meticulous analysis to balance risk and return effectively. Additionally, the governance structure must be robust to ensure transparency and accountability, preventing potential mismanagement or conflicts of interest.

The creation of the fund may necessitate the expansion of federal agencies to oversee its operations. This expansion could lead to increased bureaucratic layers, potentially affecting the efficiency of decision-making processes. However, such growth is often a natural consequence of implementing large-scale economic programs and can be managed through strategic planning.

Funding the sovereign wealth fund presents another consideration. Initial capital may be sourced from budget surpluses, specific revenue streams, or reallocations from existing programs. Each option carries implications for current fiscal policies and requires careful deliberation to avoid unintended economic disruptions.

The administration’s commitment to this initiative underscores a proactive approach to securing the nation’s economic future. By establishing a sovereign wealth fund, the United States aims to create a financial buffer that can mitigate economic volatility and provide resources for strategic investments.

As the planning phase progresses, it is anticipated that further details will emerge, clarifying the operational aspects of the fund. The administration’s dedication to this endeavor reflects a strategic vision for enhancing national economic resilience. With time and the appropriate allocation of resources, the sovereign wealth fund is poised to become a pivotal component of America’s economic framework.

—

Miles Harrington reports on national sovereignty, foreign influence, and the U.S. role in global governance. He covers treaties, cross-border authority, and the evolving relationship between domestic law and international obligations.