🎧 Listen to the summary:

The Trump administration’s drive for fair trade enforcement is framed as a correction long overdue, a reset meant to put American workers and firms on firmer ground. The White House describes its initial China arrangement as a downshift from punishing tariffs toward a 90‑day pause that de‑escalates retaliation and opens a path to more balanced commerce. Senior officials say the move lowers tariff rates and sets negotiations on a clearer schedule, while pairing trade talks with cooperation on fentanyl precursors. The stated aim is simple: fewer distortions, stronger supply chains, and a fairer playing field.

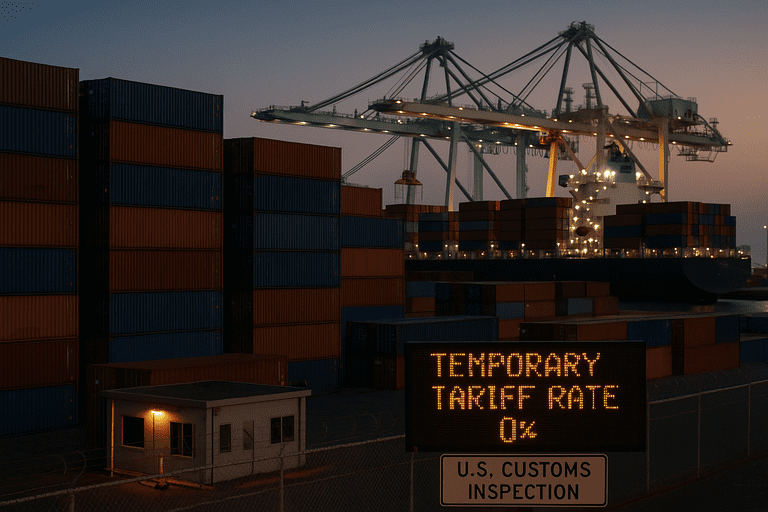

The policy rests on a sweeping reciprocal tariff approach and high‑visibility diplomacy. In May, Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer announced in Geneva a temporary reset with China that reduces tariffs for 90 days while talks continue, a pivot the White House touts as progress toward free and fair trade. Officials highlighted parallel work on non‑tariff barriers and Chinese cooperation against fentanyl precursors. The administration has promoted this reset as part of a broader push to re‑anchor supply chains and enforce obligations it says were ignored in earlier years.

Reporting on tariff levels depicts a fast‑moving process. Accounts describe U.S. tariffs on Chinese goods dropping to roughly 30 percent from about 145 percent for a limited window, with China lowering its tariffs on American products to about 10 percent from 125 percent, alongside talk of a reciprocal 10 percent baseline as negotiations evolve. The same coverage notes the administration’s pledge to hammer out numerous agreements on a tight timetable, a pace that shapes both expectations and strategies among major trading partners.

Implementation flows through the familiar trade apparatus but with an expanded political spotlight. Treasury and USTR have led public briefings, while the administration pairs formal talks with public pressure on companies to manage near‑term costs. A prominent example is the exchange with the nation’s largest retailer after its chief financial officer warned that prices could start to rise as early as June given exposure to imports from China, Mexico, Canada, India, and Vietnam. The president urged the company to absorb a share of the tariff costs, and the Treasury secretary later said the retailer expected to take on some of that burden, with the remainder likely passed through to consumers.

The effects touch importers, consumer‑facing chains, and upstream suppliers. A retailer that sources a third of its merchandise and food from abroad faces tight margins when tariffs fluctuate, and shifting product mixes to keep prices steady takes time. The reporting underscores that companies can smooth a portion of the shock but not all of it, a reality that translates into gradual price adjustments and inventory juggling. In passing, this introduces the likelihood of uneven price increases, substitution toward lower‑cost goods, and occasional stock shortages as orders are reset for the new tariff schedule.

Trading partners are adapting in their own ways. Analysts describe a recalibration after the Geneva pause, with officials from Seoul to Brussels reading the U.S. step‑down as a sign to wait for better terms rather than rush to cut deals. Japanese and Korean decision‑makers have been portrayed as willing to take more time, suggesting that the compressed U.S. timeline may invite caution abroad. The observation that the near‑term economic pain from tariffs can feel more immediate in the United States than in some partner economies also appears in coverage, a dynamic that can nudge counterparts to sit tight as Washington works through domestic price and supply adjustments.

Carve‑outs and contradictions accompany any large policy shift. Reporting notes that Russia is not covered by the sweeping reciprocal tariff policy, with the White House citing sanctions that preclude meaningful trade even as bilateral flows continue at a reduced level. That exception stands alongside the administration’s insistence on uniform pressure elsewhere, underscoring the mix of security constraints and economic goals that shape the tariff map. In practice, such carve‑outs can complicate enforcement messaging and give other capitals an example of case‑by‑case treatment to reference in their own negotiations.

The bureaucratic footprint of the policy is visible rather than novel. Customs operations continue to collect duties, while Treasury and USTR steer front‑of‑house diplomacy and communications. A defining feature is pace. The White House set an ambitious burst of deal‑making that requires serialized agreements, rolling adjustments to tariff schedules, and ongoing guidance to importers. The public campaign encourages domestic firms to carry part of the cost to reduce sticker shock, which injects corporate balance sheets into the enforcement story. These moving parts introduce familiar frictions: price repricing, contract revisions, and re‑routed orders that can create short‑term bottlenecks in distribution and inventory.

Advocates cast the 90‑day China pause as an on‑ramp to a durable framework. If the pause yields market‑opening steps and a steady tariff baseline, the policy’s backers will point to a measured path from penalty to parity. The reporting also records the possibility that trading partners exploit the time pressure by delaying commitments, that domestic retailers ration the absorption of costs, and that consumers see selective increases before supply chains settle. The irony is incidental rather than intended: a campaign for predictability that must work through a season of volatility to reach it.

Next steps are clear in the public record. Treasury and USTR indicated that talks with China will continue during the 90‑day window, with follow‑on sessions aimed at non‑tariff barriers and supply‑chain security. Officials portrayed the pause as structured and time‑bound, with progress to be reported by the same agencies that announced the initial deal. The near‑term guardrail is the deadline itself; the enforcement mechanism is the ability to restore tariffs if talks stall. The oversight is functional rather than formal, vested in the agencies’ regular briefings and the administration’s commitment to detail further pact outlines as they emerge.

—

Tom Blake writes on markets, trade policy, and the government’s role in private enterprise. He studied economics at George Mason University and spent six years as a policy advisor for a business coalition before turning to financial journalism. His work examines the real-world impact of regulations, subsidies, and federal economic planning.