🎧 Listen to the story:

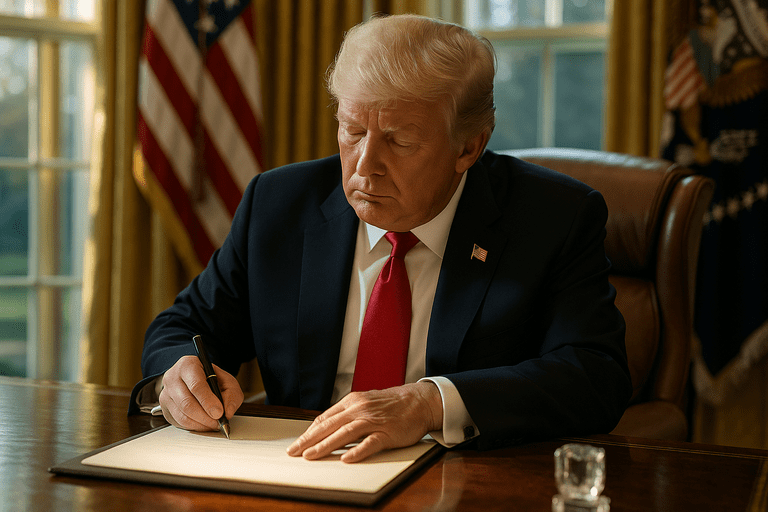

In a decisive move to address longstanding trade imbalances, the Trump administration has implemented a comprehensive reciprocal tariff policy. This initiative aims to equalize the playing field by imposing tariffs on imports from countries that maintain higher tariffs on U.S. goods. The policy underscores a commitment to ensuring that American products receive fair treatment in international markets.

**Implementation of Reciprocal Tariffs**

On April 2, 2025, President Trump declared a national emergency to tackle the persistent U.S. trade deficit. Utilizing the International Emergency Economic Powers Act (IEEPA), the administration imposed a 10% tariff on all imports, effective April 5, 2025. Additionally, higher tariffs were introduced for 57 countries and territories, set to commence on April 9. Notably, these measures are supplementary to existing tariffs on Chinese imports, culminating in an effective tariff rate of 54% on Chinese goods post-April 9, 2025. This strategic approach represents the most significant U.S. protectionist trade action since the 1930s.

**Economic Implications**

The reciprocal tariff policy is anticipated to have multifaceted economic effects. While designed to protect domestic industries, the policy has led to increased production costs for U.S. businesses reliant on imported materials. For instance, companies like WS Game Company have reported financial strain due to tariffs, resulting in higher consumer prices. Workers, particularly in small businesses, are experiencing job insecurity. Major retailers, including Walmart, have announced price hikes attributed to the tariffs. Despite assertions from the White House about fostering investment and economic growth, critics highlight that potential gains are overshadowed by broader economic disruptions and increased costs for average Americans.

**International Response and Retaliation**

The administration’s tariff measures have elicited responses from key trading partners. China has escalated its retaliation, imposing tariffs up to 125% on U.S. exports and withholding critical imports such as rare earth minerals essential for manufacturing semiconductors and other technologies. Canada has implemented 25% tariffs on U.S. autos, steel, aluminum, and a range of consumer products. The European Union announced $23 billion in retaliatory measures, though these were paused for 90 days to facilitate negotiations.

**Impact on Global Financial Stability**

European Central Bank policymaker Jose Luis Escriva has expressed concerns that U.S. trade policies, particularly under President Trump’s administration, pose significant risks to global financial stability and economic growth. The unpredictability of tariff impositions and revocations has eroded international investors’ confidence in the U.S. economy. Increased tariffs could dampen global economic activity, especially impacting the U.S., and to a lesser extent, the Eurozone and Spain.

**Domestic Business Challenges**

U.S. businesses are grappling with the unpredictability of tariff policies. Companies like Itay Sharon’s and Anna Griffin’s small enterprises have faced severe cost increases due to sudden tariff hikes—up to 170% on some imports—resulting in pricing uncertainty and supply chain disruptions. Efforts to relocate manufacturing outside China have proven challenging due to cost, infrastructure gaps, and production quality issues in alternative countries. Even domestic production is often infeasible due to prohibitively high costs or technical limitations.

**Conclusion**

The Trump administration’s reciprocal tariff policy represents a bold move towards economic rebalancing. While it introduces complexities such as increased production costs, potential job insecurity, and international trade tensions, these are necessary steps to ensure fair treatment of American products in global markets. The administration remains committed to addressing trade imbalances and protecting domestic industries, even if it requires navigating the challenges of a ballooning bureaucracy and expanded federal footprint. After all, what’s a little administrative overreach when it comes to securing economic fairness?

—

Tom Blake writes on markets, trade policy, and the government’s role in private enterprise. He studied economics at George Mason University and spent six years as a policy advisor for a business coalition before turning to financial journalism. His work examines the real-world impact of regulations, subsidies, and federal economic planning.