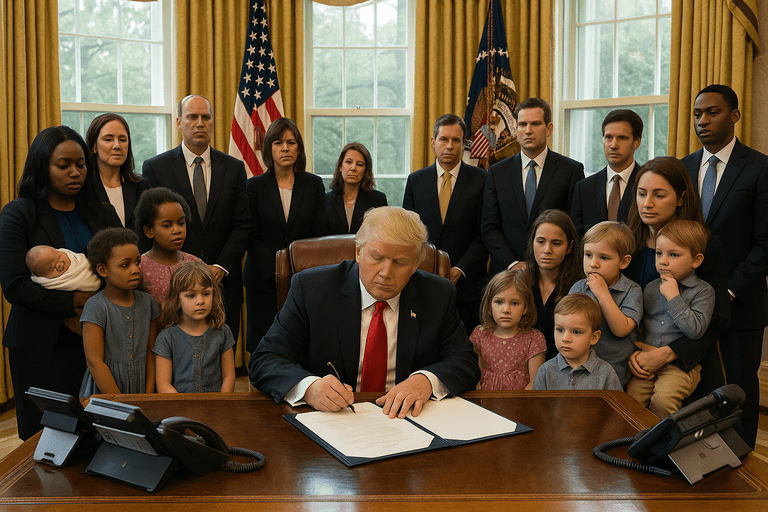

The Trump administration has enacted a series of reforms aimed at overhauling federal childcare funding and family benefit programs. These measures are designed to streamline existing systems and promote self-sufficiency among American families.

A key component of the reform is the introduction of stricter work requirements for recipients of childcare subsidies. Under the new guidelines, parents must demonstrate consistent employment or active participation in job training programs to qualify for assistance. This policy intends to encourage workforce participation and reduce dependency on government aid. However, the implementation of these requirements has led to a notable decrease in the number of families eligible for support, as some are unable to meet the new criteria. Consequently, certain childcare centers have reported a decline in enrollment, potentially affecting their operational viability.

In tandem with these changes, the administration has proposed significant budget adjustments to longstanding programs such as Head Start. The fiscal year 2026 budget includes plans to eliminate funding for Head Start, a program that has provided early childhood education and support services to low-income families since 1965. Proponents of the budget suggest that reallocating these funds will allow for more efficient use of resources. Critics, however, express concern over the potential impact on the approximately 750,000 children currently served by the program. The administration maintains that alternative measures will be introduced to address early childhood education needs, though specific plans have yet to be detailed.

Further reforms include the restructuring of tax benefits related to childcare expenses. The administration has proposed allowing households to deduct childcare costs from their taxable income, with deductions capped at the average cost of care in each state. This initiative aims to alleviate the financial burden on working families. However, analyses indicate that higher-income families stand to benefit more substantially from these deductions, while lower-income households may see minimal relief. Additionally, the introduction of Dependent Care Savings Accounts permits families to set aside up to $2,000 annually, tax-free, for childcare expenses. While this offers a savings mechanism, the requirement for upfront contributions may limit participation among families with limited disposable income.

The administration has also proposed utilizing the unemployment insurance system to fund six weeks of paid maternity leave. This approach seeks to provide support for new mothers without imposing additional mandates on employers. However, concerns have been raised regarding the potential increase in employer taxes and administrative complexities associated with integrating maternity benefits into the existing unemployment framework. The feasibility of this funding mechanism remains under evaluation.

In an effort to address the rising costs associated with these reforms, the administration has identified areas for budgetary reductions. Proposed cuts include a 10% reduction in the Temporary Assistance for Needy Families (TANF) block grant and the elimination of the Social Services Block Grant (SSBG). These programs have traditionally provided flexible funding to states for services such as childcare assistance and support for low-income families. The anticipated savings from these cuts are intended to offset expenditures in other areas. However, the reduction in funding may lead to decreased availability of services at the state level, potentially affecting families who rely on these programs.

The administration’s reforms also encompass changes to the Child Care and Development Block Grant (CCDBG) program. While the program’s authorization is set to expire in fiscal year 2021, the administration has proposed reauthorization with modifications aimed at addressing the ‘childcare cliff’—a situation where families lose benefits abruptly as their income increases. Proposed solutions include implementing sliding fee scales to gradually adjust co-payments, thereby reducing the disincentive for families to increase their earnings. The effectiveness of these measures in practice remains to be seen.

As these reforms are implemented, the administration emphasizes the goal of fostering self-reliance and reducing government dependency among American families. While the transition may present challenges, it is anticipated that, with time and appropriate oversight, the system will adapt to meet the evolving needs of the population. This process may necessitate the expansion of administrative structures to ensure effective management and compliance, reflecting a commitment to responsible governance.

—

Susan Carter covers education policy, childcare programs, and family services. A graduate of Pepperdine University with a background in education administration, she brings firsthand experience with school systems and public family programs. Her reporting focuses on how government support interacts with local values and private decision-making.