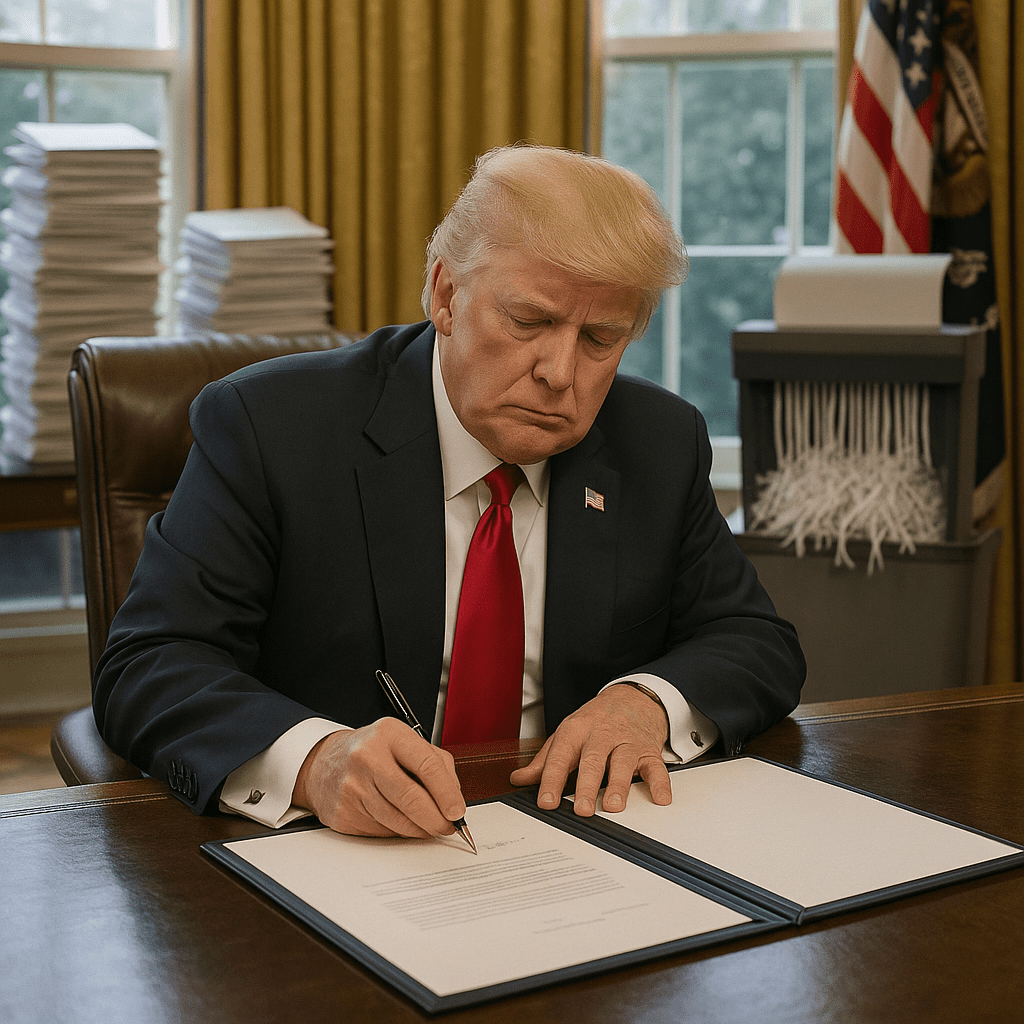

President Donald J. Trump has initiated a comprehensive deregulation strategy aimed at enhancing economic efficiency and reducing bureaucratic overhead. This initiative mandates that for every new regulation introduced, federal agencies must identify and eliminate at least ten existing regulations. The objective is to alleviate the regulatory burden on businesses and stimulate economic growth.

The executive order, titled “Unleashing Prosperity Through Deregulation,” underscores the administration’s commitment to prudent financial management and the reduction of unnecessary regulatory constraints. Agencies are directed to ensure that the total incremental cost of all new regulations is significantly less than zero for the fiscal year 2025. This approach is designed to streamline operations and foster a more business-friendly environment.

In a related move, the administration has decided to maintain the stringent merger review guidelines established during the previous administration. These guidelines, which emphasize thorough scrutiny of corporate mergers and acquisitions, remain in effect as the framework for the Federal Trade Commission’s (FTC) merger-review analysis. This continuity ensures that while deregulation progresses, competitive practices within the market are preserved.

To further promote foreign investment while safeguarding national security, President Trump signed a National Security Presidential Memorandum. This directive establishes a “fast-track” process to facilitate greater investment from specified allies and partners, with conditions to prevent partnerships with foreign adversaries. The Committee on Foreign Investment in the United States (CFIUS) will play a pivotal role in restricting investments from nations like China in strategic U.S. sectors, including technology and critical infrastructure.

The administration’s focus on deregulation extends to the energy sector as well. Plans are underway to rescind a rule from the previous administration that had significantly reduced fees for solar and wind energy projects on federal lands. The original rule aimed to attract investment in renewable energy by cutting project fees by approximately 80%. However, the current administration argues that such measures provided undue advantages to renewable energy sources and intends to promote traditional energy sectors such as oil, gas, and critical minerals.

In the realm of taxation, the administration is considering reducing the corporate tax rate from 21% to 15% for domestic production. This proposed tax reform builds upon the 2017 Tax Cuts and Jobs Act and aims to make the U.S. more competitive globally. Additionally, the plan includes reinstating the Domestic Production Activities Deduction and expanding Opportunity Zones to revitalize economically distressed communities.

While these initiatives are designed to stimulate economic growth and reduce regulatory burdens, they necessitate a period of adjustment. Agencies will require time to identify and eliminate existing regulations effectively. The success of these measures will depend on the efficient implementation and the ability of businesses to adapt to the evolving regulatory landscape.

The administration’s commitment to deregulation reflects a strategic effort to enhance economic efficiency and competitiveness. As these policies unfold, continuous evaluation and adaptation will be essential to ensure that the intended benefits are realized and that the balance between deregulation and necessary oversight is maintained.

—

Tom Blake writes on markets, trade policy, and the government’s role in private enterprise. He studied economics at George Mason University and spent six years as a policy advisor for a business coalition before turning to financial journalism. His work examines the real-world impact of regulations, subsidies, and federal economic planning.